This section highlights important points about integrity and transparency to ensure councillors and mayors act fairly and in the public interest.

To put the public interest first, public officials should:

- Perform their duties fully and effectively.

- Behave ethically and legally.

- Identify and declare any conflicts of interest and manage them properly.

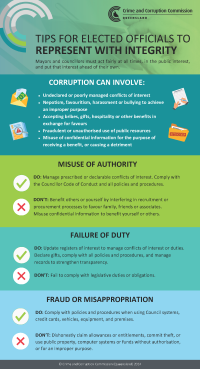

Top tips to represent with integrityCouncillors and mayors must act fairly at all times, in the public interest, and put that interest ahead of their own. |

|---|

Corruption can involve:

|

Misuse of authority DO: Manage prescribed or declarable conflicts of interest. Comply with the Councillor Code of Conduct and all policies and procedures. DON’T: Benefit others or yourself by interfering in recruitment or procurement processes to favour family, friends or associates. Misuse confidential information to benefit yourself or others. |

Failure of duty DO: Update registers of interest to manage conflicts of interest or duties. Declare gifts, comply with all policies and procedures, and manage records to strengthen transparency. DON’T: Fail to comply with legislative duties or obligations. |

Fraud or misappropriation DO: Comply with policies and procedures when using Council systems, credit cards, vehicles, equipment and premises. DON’T: Dishonestly claim allowances or entitlements, commit theft, or use public property, computer systems or funds without authorisation, or for an improper purpose. |

1.) Identify conflicting duties

Public officials need to be aware of situations that might lead to competing interests or conflicts of duty. These situations are like conflicts of interest and should be managed in the same way. The key principle is that all public decisions should be impartial and based on the merits of the situation, without improper influence. The strategies for managing conflicts of interest also apply to these scenarios to ensure fairness and transparency.

Here are two common scenarios:

1.1 Multiple roles

Sometimes, a public official might have multiple roles. For example, a councillor might also be an executive member of a community group, like a local nature preservation or sporting group. Problems can arise if the duties of these roles conflict, especially if the organisations have a competitive relationship or if one role involves regulating or reviewing the other.

1.2 Access to confidential information

Another issue can occur if a public official gains confidential information in one role that could be useful in another role. For example, a councillor might serve on multiple subcommittees, such as those for infrastructure development and nature preservation. The risk here is that the official might misuse the information to benefit one organisation or harm another.

2.) Do not misuse information

It's against the law for current or former councillors to use information they got from their job as a councillor to gain a financial a advantage for themselves or others, or to harm the council. See the Local Government Act (LGA; s. 171) and the City of Brisbane Act (COBA; s. 173)

Key points to remember:

- Using information for financial gain: Councillors cannot use information from their role to make money for themselves or someone else.

- Causing harm to the council: Councillors cannot use information to harm the council.

- Releasing confidential information: Councillors must not share confidential information. Doing so is considered misconduct.

- Inside information and assets: Councillors cannot use inside information to buy or sell assets (see LGA s. 201F and the COBA s. 198F)

- Respecting the classification of information (like confidential or restricted) is crucial to protect its content and the council's integrity. The only exception is if the information was already public.

Councillors get information from various sources, including:

- Conversations with the public or council officers.

- Reports, letters, files, or briefing notes.

- Council meetings, briefings, workshops, committees, closed sessions, and agenda papers.

The security and confidentiality of this information depends on its source and content. Councillors should only discuss this information with the person who sent it or in approved forums.

The only exception to this is when the information was lawfully available to the public in the first instance.

Not doing so may constitute misconduct, risk a criminal conviction and disqualification as a councillor.

| Learn More Corruption Prevention Advisory: Misuse of confidential information |

3.) Manage records appropriately

Any record created or received by a mayor or councillor that relates to council business is considered a public record.

Here are some examples:

- Council documents: Communications about the adoption and implementation of policy and local laws.

- Policy communications: Messages about adopting and implementing policies and local laws.

- Letters from constituents: Letters addressed to a mayor or councillor about council business.

- Internal memos: Notes written by a mayor or councillor to their CEO.

- Social media posts: Any posts about council-related matters that are part of their responsibilities.

- Appointment diaries: A mayor or councillor’s schedule of council-related appointments and meetings.

Records related to personal activities, political memberships, or divisional activities are not considered public records and don't need to be managed as such.

Note: The new Public Records Act 2023 comes into effect from 5 December 2024. Until then, the Public Records Act 2002 continues to apply. Find out more here.

Learn more Council records: A guideline for mayors, councillors, CEOs, and government employees |

1.) Manage and declare gifts and benefits

From time to time, elected officials may be offered a gift or some other benefit in their official capacity as a member of the council. It is important to consider the implications of accepting the gift or benefit.

What is a gift?

A gift can be any valuable item given to you as an official. This could include money, vouchers, entertainment, hospitality, travel, services, or property. Sometimes, gifts are given to show appreciation, but they can also create a sense of obligation.

- Conflict of interest (COI): If a gift affects your decision-making, it might be a conflict of interest. Check the COI definition in Chapter 5B, Part two of the Local Government Act (LGA) and chapter 6, part 2, division 5A of the City of Brisbane Act (COBA).

- Register of interests: If the gift, or series of gifts from the same source is worth over $500, you must record it in the Register of Interests (LGR Schedule 5, s. 12) or CoB Regulation 2012 Schedule 3, s.12). There are exceptions to this, so make yourself familiar with the relevant legislative sections.

- Electoral Commission Queensland (ECQ) disclosures: All details of donations and loans made, and expenditure incurred towards an election, must be disclosed to the Electoral Commission Queensland. If you receive a gift related to your election campaign, you must disclose it to the ECQ. Find out more.

What is a benefit?

A benefit is similar to a gift but is less tangible. It could include preferential treatment, discounts, personal services, access to confidential information, honorary memberships, or benefits to friends or relatives like a new job or promotion. These must also be recorded in the Register of Interests if they involve sponsored travel or accommodation benefits (see LGR Schedule 5 Section 13 and CoB Regulation 2012 Schedule 3, s. 13)

Declaring gifts and benefits

As a councillor, you must always maintain transparency and integrity. Here's how to handle gifts and benefits:

- Any gift offered to you in your official capacity belongs to the council, not you personally.

- Declare any gift or benefit according to your council's policy (if available). The Chief Executive Officer or a delegated official will decide what to do with it.

Many council's gifts and benefits policies include:

- a value threshold below which small or token gifts do not need to be declared

- a process for keeping declared gifts

- special conditions for culturally or historically significant gifts

- arrangements for any tax obligations

- a process to maintain and publish the Register of Gifts and Benefits.

Important note: All gifts can create a conflict of interest and should be declared in meetings where matters related to the donor are discussed. The key issue is not whether something was done in return for the gift, but whether accepting it could be seen as influencing your conduct. By following these guidelines, you can ensure you act with integrity and transparency, maintaining public trust in your role as an elected official. |

2.) Decline and report bribes and secret commissions

A ‘bribe’ is anything offered to a public official to influence their actions and make them act against the public interest, dishonestly or unethically.

Bribery is illegal under the Criminal Code Act 1899 (refer s. 87, 442B and 442BA).

What to do if offered a bribe

If you are offered a bribe:

- Decline the offer: Do not accept the bribe.

- Report immediately: Inform the CEO right away.

- Further actions: The CEO will decide whether to refer the matter to the Queensland Police Service (QPS) or the Crime and Corruption Commission (CCC), as bribing a public official is a serious offence.

Learn more |

3.) Use of official resources

Using official resources properly is important. Councillors have access to a range of resources to assist in carrying out official duties. These may be assets, services, or consumables — in other words, anything paid for or provided by the council.

They include:

- time which is being paid for by the council (staff, contractors, or councillor’s own time)

- council money (for example, petty cash, general fund and trust fund money)

- communication and information devices (computer equipment and phones, internet, and email services)

- services provided by council staff

- office space, fit outs, and furniture

- motor vehicles, fuel, spare parts, and motor accessories

- office equipment (photocopiers, staplers, guillotines, laminators etc.) and stationery (paper, staples, binders etc.)

- tools, machinery, or other equipment (from offices, libraries, vehicles etc.)

- participation in conferences, seminars, and other events

- travel, accommodation, and transportation.

Rules for using official resources

Elected officials must not use these resources for private purposes unless:

- they are authorised by council policy or contract to do so (for example, private use of a motor vehicle)

- they have written approval from the CEO

- they have paid the appropriate hire fee

- the particular use is defined by a council policy as reasonable use.

The public interest must always come first. Approved personal use of official resources should never interfere with council operations.

When using publicly funded resources, councillors should always consider:

- Is the use reasonable?

- Could it be seen as misuse?

- Is there any risk of damaging property or the council’s reputation?

The definition of 'reasonable use' can vary and should be assessed case by case. Reasonable use generally means infrequent, limited use that doesn’t involve significant expense or time. For example:

- Appropriate use: Making a quick personal call to book a doctor’s appointment.

- Inappropriate use: Making numerous lengthy personal calls, especially if they are interstate or overseas.

Learn more |

1.) What is a conflict of interest (COI)?

A conflict of interest (COI) happens when a public official's duty to serve the public interest clashes with their private interests. Conflicts of interest are not necessarily wrong, but they must be managed properly to maintain public trust.

To maintain trust, it's important to:

- Identify and declare any conflicts of interest.

- Ensure these conflicts are managed effectively.

- Make decisions that benefit the community, not personal interests.

Failing to declare a conflict of interest can be seen as hiding something deliberately, which is often viewed as more serious than the conflict itself.

The volume and nature of decisions and actions taken by councillors, that affect members of a local community, means you may have a higher number of conflicts of interest to manage than some other elected officials. This can be more apparent in remote or regional communities, where public officers will have close involvement in community interests. At all times, councillors should be mindful of acting (and being seen to act) in the public interest. |

2.) Managing conflicts of interest

Four guiding principles to help manage conflicts of interest:

- Protect the public interest.

- Support transparency and accountability.

- Promote individual responsibility and personal example.

- Build a supportive organisational culture.

3.) Types of conflicts

Under the Local Government Act (LGA) and the City of Brisbane Act (COBA), councillors must declare their conflicts of interest. They must not participate in decisions about the matter unless approved by the Minister or other councillors.

Prescribed conflicts of interest (PCOI)

- Defined by receiving gifts, loans, or benefits from someone interested in a decision such as travel or accommodation.

- Includes decisions directly involving the councillor, like contracts with the council.

- A gift or loan to a councillor or their close associate (family, employer, or business partner) is a prescribed COI if it’s worth $2,000 or more from the same donor during the “relevant term for the councillor”.

| The phrase “relevant term for the councillor” (defined in schedule 4 of the LGA and schedule 2 of the COBA) means the combined period of the councillor’s current term and the council term before that, regardless of whether the councillor held office in that previous term. |

Declarable conflicts of interest (COI)

Occurs if a councillor has (or could reasonably be presumed to have):

- a conflict between their personal interests and the public interest, and

- this conflict could lead to a decision that’s not in the public interest.

4.) Legislation sections relevant to COI

For more detailed information on managing COI, see chapter 5B of the LGA and chapter 6, part 2, division 5A of the COBA.

Visit LG Central to learn more and download COI resources: |